The Wednesday Letter #205 - 1/31/2024

THIS WEEK: Copper's Impossible Calculus; Debt Projections and Health Costs; Texas vs. Biden; Foreign Policy Capture; NVIDIA; Musk and $55 Billion.

COPPER’S IMPOSSIBLE CALCULUS

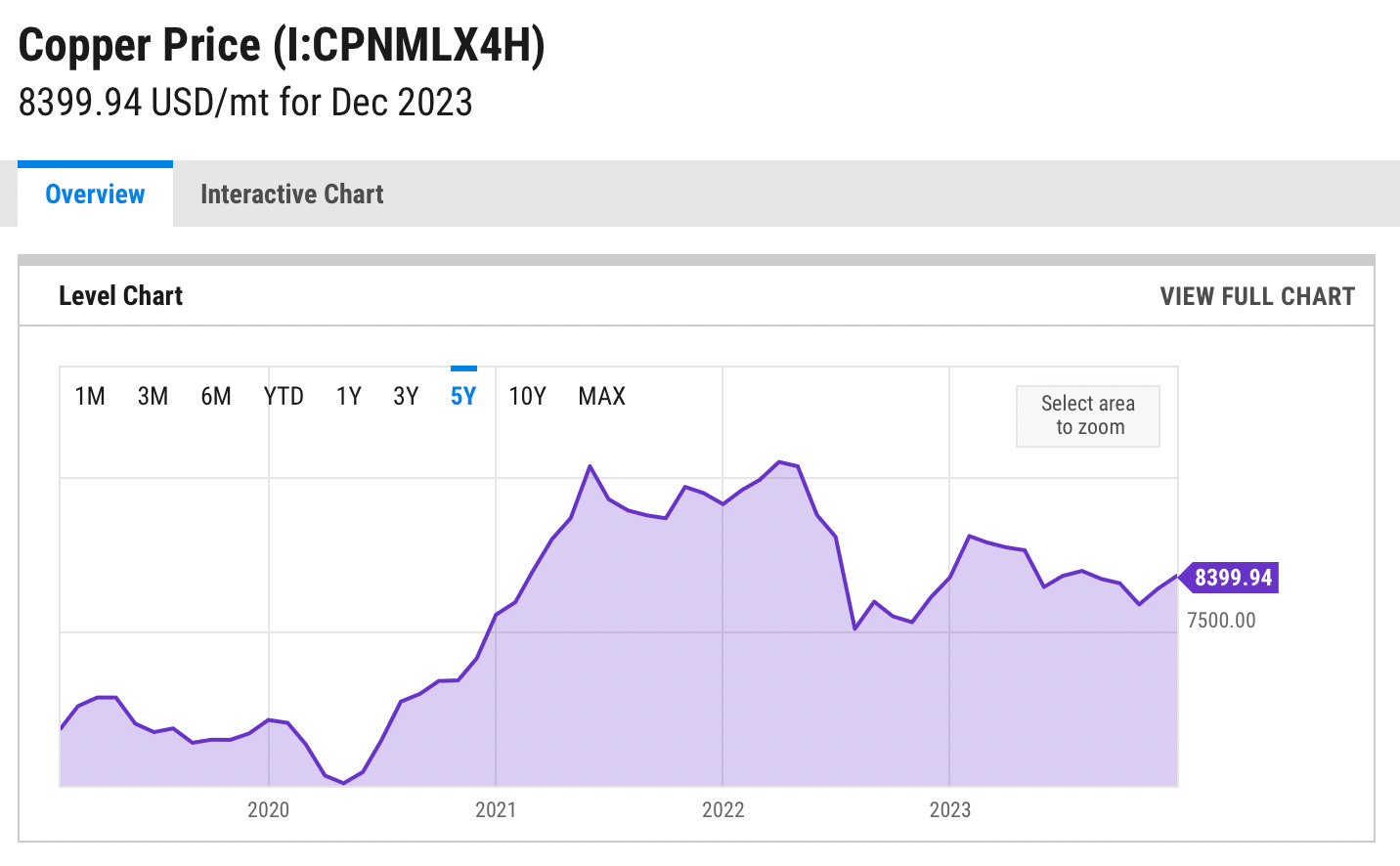

Some commentators have puzzled over the fact that the price of copper has held up rather well in the past year while news from the Chinese economy has deteriorated. China was for decades the main source of incremental demand for industrial commodities. This was especially true of copper, a metal that is used extensively in electrification, construction and infrastructure, three of China’s primary development efforts towards modernization since the 1990s. Now that China’s real estate sector is struggling (see Evergrande’s ordered liquidation this week) from overbuilding and over-indebtedness, and that infrastructure spending appears to be slowing, it was a logical conclusion for many that the price of copper should be receding. Instead, as shown in the chart, it has remained comfortably over $7,500 per tonne.

This resilience is due to at least three other factors: One, as Ivanhoe Mines founder Robert Friedland states in this Bloomberg interview, Chinese deman…