The Wednesday Letter #269 - 4/23/2025

THIS WEEK: The Human Exception; Notable Q1 Earnings: Tesla, Intuitive Surgical, Boeing; Copper as a War Bellwether; Contours of a Ukraine “Peace”; The Anti-Expert Movement.

Topics this week:

The Human Exception

Notable Q1 Earnings: Tesla, Intuitive Surgical, Boeing

Copper as a War Bellwether

Contours of a Ukraine “Peace”

The Anti-Expert Movement

THE HUMAN EXCEPTION

Unless you subscribed to The Wednesday Letter only recently, you already know that Richard Sprague and I co-write the InvestAI weekly column here. A few weeks ago, we took a break from the column in order to complete a book about AI that synthesized all the work that we had done so far.

Now, introducing… (drumroll)… THE HUMAN EXCEPTION: Why Human Judgment Becomes More Valuable, Not Less, in an AI World, available on Amazon.

Richard and I put forward the idea that AI will be a powerful assistant but that it will never take the lead in any project involving a moderate-to-high level of complexity. Instead, we argue that humans will remain the indispensable leaders and actors at the center of these projects. We showcase this idea by organizing and writing this book, while enrolling AI as an assistant to contribute some parts.

Without further ado, I am posting here the preface that summarizes our effort and explains how we wrote it. In the next week or so, I will post another excerpt.

We designed the cover with Copilot. It shows the human leader, free and in charge, while robots remain tethered by their limitations. The person holding a book represents the human exception, a level of human intelligence and synthesis that will always be beyond the reach of AI.

PREFACE

In early 2025, Bill Gates was a guest on NBC’s The Tonight Show with Jimmy Fallon. Speaking of AI, Gates said to Fallon:

“The era that we are just starting is that intelligence is rare, you know, a great doctor, a great teacher. And with AI, over the next decade, that will become free, commonplace: great medical advice, great tutoring. And it’s kind of profound because it solves all these specific problems, like we don’t have enough doctors or mental health professionals. But it brings with it so much change, what will jobs be like, should we just work two or three days a week? So I love the way it will drive innovation forward, but I think it’s a little bit unknown. Will we be able to shape it? And so, legitimately, people are wow, this is a bit scary, it’s completely new territory.”

Asked then by Fallon whether we will “still need humans”, Gates answered “not for most things” and then “there will be some things that we reserve for ourselves, but in terms of making things, and moving things and growing food, over time, those will be basically solved problems.”

In these few sentences, Gates touched on the main themes of this book: the role of AI in performing basic tasks, the uncertainty concerning many occupations, the scariness of new territory, and the fact that some things will remain reserved for human beings.

In this book, we present a thesis that the human being will remain at the center of the AI revolution. Some jobs will disappear but other new ones will be created. We also differentiate between the ‘how’ and the ‘what’ involved in every project. AI models will excel at the ‘how’, but human beings will remain unmatched in the ‘what’.

The archetype project of the future, as we envision it, will be largely carried out by robots or AI models but it will still be directed, masterminded, choreographed and led by humans who will remain the indispensable actors in the effort.

We propose this book as an example of such a project. First the two of us worked together for eight months, writing a weekly AI-themed column on Substack. Second, we created an outline for this book. Third, we fed Claude all of the columns that we had written and asked it to start generating the chapters of the book according to the outline. Fourth, we fact-checked the text and prompted Claude to make changes in order to refine the chapters. Finally, we edited the text in the traditional way to improve it and to remove redundancies or inconsistencies. This process exemplifies our notion of how AI will be used in the future, not to replace human beings, but to enhance their work.

Each of us brought decades of experience that were complementary to the other, Richard from the tech world and Sami from the financial world. This wide combined expertise allowed us to approach the question of AI in the future world not only from a technical perspective but also with the mind of an investor.

So is this an AI-written book? Yes and no, but mostly no. Yes, in the sense that several sections of the text were AI-generated. No, and this is in our view the critical qualifier, because AI generated those sections after training itself on text that we had previously written in the traditional (non AI-assisted) way. No also because we corrected, fact-checked and edited all AI-generated text. We used AI as a powerful assistant, but the end result is a product of two humans.

As we write in chapter 3, “the key question is no longer whether AI will replace human authors, but how it will transform the authorship process. The answer lies in recognizing that while AI can move mountains of words, humans must still decide which mountains to move and how to shape the resulting landscape.”

At the same time, it was important to us to do an editing job that was not too extensive because that would defeat the thesis that AI can do a large share of the work. Many sections were left intact as produced by Claude.

To the extent that some errors have survived the final cut, they should be attributed to AI and not to any motive on our part to mislead or misinform.

Finally, AI can sometimes be repetitive. We have reduced repetition as much as possible, while being mindful not to re-write entire sections. The end product is intended to showcase our central thesis, which is that AI is a powerful assistant, but the human will retain the lead in every project.

NOTABLE Q1 EARNINGS: TESLA, INTUITIVE SURGICAL, BOEING

Tesla’s Q1 earnings were disastrous. Revenues fell 9% year-on-year and net income was down 71% (chart). Auto revenues were down 20%. The only semi-bright spot was that gross margin was better than expected. Tesla hit a perfect storm of 1) desertion by some customers due to Elon Musk’s alignment with the Trump administration, 2) the surge of BYD and other Chinese competitors overseas, 3) poor CyberTruck sales, 4) an increasingly stale product lineup. However, much of this was already priced into the stock which has fallen by half since December. It is up 6% in the pre-market this morning on news that Musk will reduce his DOGE activities and allocate more of his time to Tesla. Some shareholders are calling for Musk to be replaced. In my view, were Musk to relinquish the CEO job, the stock would drop much further. The main reason it still trades at high multiples is the hefty Elon premium.

Intuitive Surgical had good numbers but made cautious forward statements related to tariffs. Revenues rose 19% year-on-year and net income 20%, both ahead of expectations. The gross margin was down slightly but is still strong at 66.4%. The stock initially slipped after the earnings but is flat now pre-market. It is down 22% since a January peak. Valuation looks reasonable at 1.7x revenues but looks nominally stretched at 60x earnings. Intuitive’s revenue growth and gross margin are similar to those of top tech companies, but free cash flow conversion is lower.

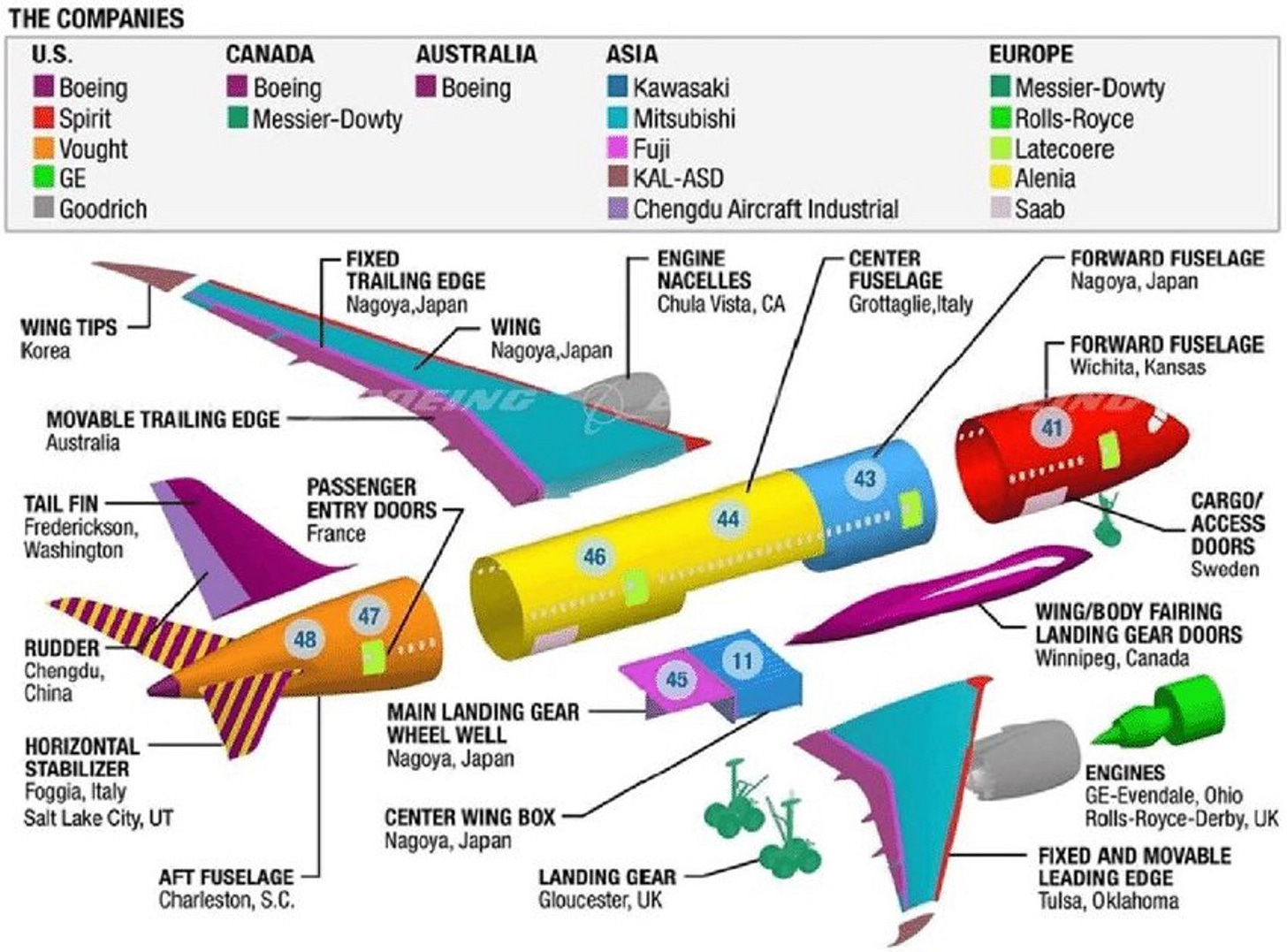

Boeing reported this morning better than expected earnings. It reported a net loss but a smaller one than expected. Revenues rose a robust 18% and cash burn was better than expected. Boeing has struggled with bad results for years, first due to two fatal crashes of its 737 MAX plane in 2018/19 and later due to cost overruns in its defense business. It is in the midst of a turnaround and is particularly vulnerable to the impact of new tariffs, given that it sells a large number of planes overseas and that it sources a large number of components from other countries. It will be at a huge competitive disadvantage vs Airbus if current tariffs remain in place. Here is an image from the company showing where it sources components overseas.

COPPER AS A WAR BELLWETHER

Torsten Sløk, who is chief economist at Apollo Asset Management, says that if tariffs stay in place as currently configured, the probability of a US recession in 2025 is 90%. This is a polite way of saying 100%. In fact, we may already be in a recession, albeit a technical one, because a tariff-beating import surge in the first quarter has certainly depressed GDP.

That said, the commodity most watched for its ability to predict the economy, aka Dr. Copper or “the commodity with a PhD in economics”, is not currently telegraphing the word recession. In fact, it is within 10% of the all-time high that it made last month (chart).

There is a less happy asterisk to this comforting story. It is possible that a sizable demand for copper is currently coming from weapons manufacturers. We know that Europe has ramped up its military spending, and that defense outlays remain at elevated levels in the US, Russia and China. If there is a Ukraine settlement, the price of copper may foretell whether geopolitical pressures and the likelihood of more war are truly receding, or whether the various parties are merely using the ceasefire to resupply their forces.

Keep reading with a 7-day free trial

Subscribe to The Wednesday Letter to keep reading this post and get 7 days of free access to the full post archives.