1

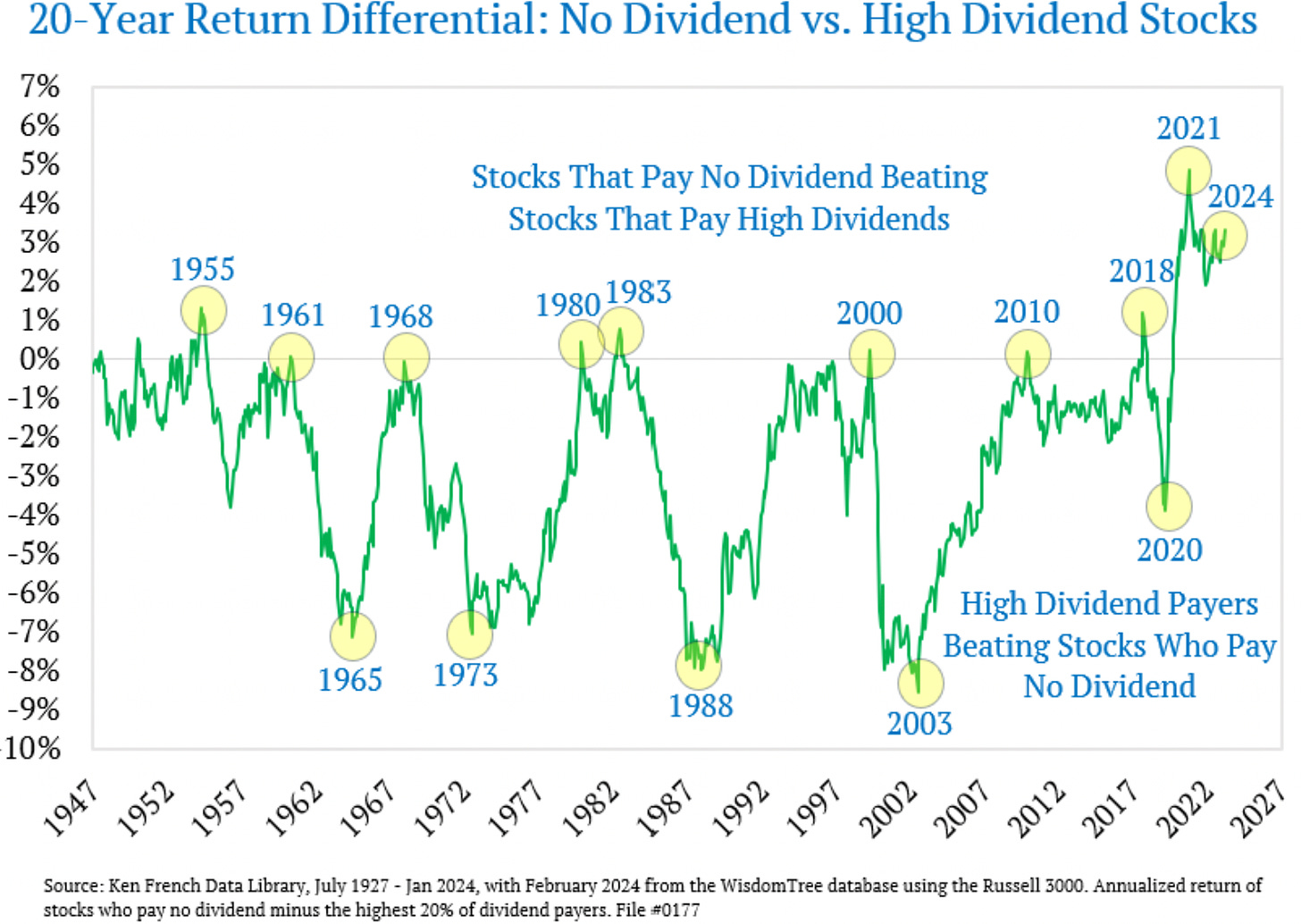

More evidence that the current stock market is abnormal. This chart shows the 20-year return differential of NO DIVIDEND VS. HIGH DIVIDEND STOCKS. High-dividend stocks are defined here as stocks in the highest quintile (top 20%) in terms of dividend yields. The differential is the difference in returns between stocks that pay no dividends and stocks that pay the highest dividends (highest in terms of yields). Looking back twenty years to 2005-2024, the current differential is only modestly below the peak of 2021. And it is not only because of the Magnificent Seven. In fact, four of them are not part of this calculation at all. Apple, Meta, Microsoft and NVIDIA do pay dividends but are not in the first quintile of payers. Amazon, Google and Tesla pay no dividends and are included in this calculation. (via @JeffWeniger)